The role of AI in enhancing digital finance solutions sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the impact of AI on digital finance, we uncover a world where technology and financial services intertwine seamlessly to create innovative solutions for businesses and consumers alike.

Importance of AI in Digital Finance

AI is playing a crucial role in revolutionizing digital finance solutions by providing advanced algorithms and data analysis capabilities. This technology is enhancing efficiency, accuracy, and personalized services in the financial sector.

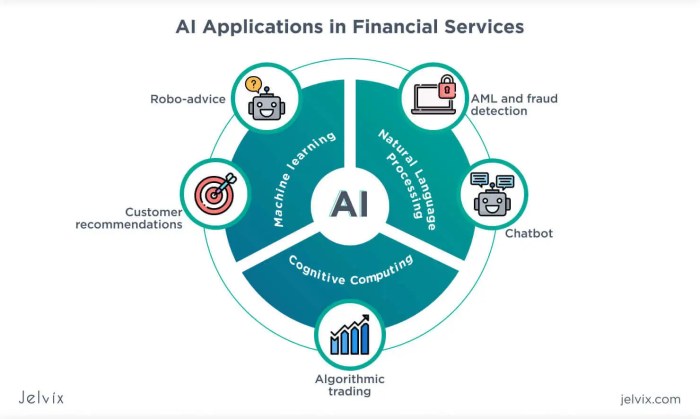

Key AI Technologies in Digital Finance

- Natural Language Processing (NLP): NLP helps in understanding and analyzing human language, enabling chatbots and virtual assistants to interact with customers for inquiries and transactions.

- Machine Learning: Machine learning algorithms are used to identify patterns in financial data, detect fraud, and make personalized recommendations to users based on their behavior.

- Robotic Process Automation (RPA): RPA automates repetitive tasks such as data entry, reducing errors and improving operational efficiency in financial processes.

Successful AI Implementations in Digital Finance

- Algorithmic Trading: AI algorithms are used to analyze market trends and make real-time trading decisions, increasing the speed and accuracy of financial transactions.

- Credit Scoring: AI models analyze customer data to assess credit risk and determine loan approvals, streamlining the lending process for financial institutions.

- Fraud Detection: AI algorithms can detect suspicious activities and patterns in financial transactions, helping in preventing fraud and ensuring the security of digital finance platforms.

AI Applications in Financial Decision Making

AI plays a crucial role in optimizing financial decision-making processes within the digital finance sector. By leveraging advanced algorithms and machine learning capabilities, AI technologies can provide valuable insights and recommendations to help financial institutions and professionals make strategic decisions quickly and efficiently.

Role of AI in Risk Management

AI is extensively used in risk management within digital finance to identify, assess, and mitigate potential risks. By analyzing vast amounts of data in real-time, AI algorithms can detect patterns, anomalies, and trends that human analysts may overlook. This enables financial institutions to proactively manage risks, prevent fraudulent activities, and ensure compliance with regulatory requirements.

- AI-powered predictive analytics tools can assess credit risk by analyzing borrowers’ financial data, payment histories, and market conditions to determine the likelihood of default.

- Machine learning algorithms can improve fraud detection by identifying suspicious patterns and anomalies in transaction data, helping financial institutions prevent fraudulent activities and protect their customers’ assets.

- AI-based tools like chatbots and virtual assistants can enhance customer service by providing personalized financial advice, answering queries, and assisting customers in managing their investments effectively.

Enhancing Customer Experience with AI

AI technologies play a crucial role in enhancing customer experience in the realm of digital finance. By leveraging AI, financial institutions can provide more personalized and efficient services to their customers, ultimately improving overall satisfaction and loyalty.

AI-driven Customer Service in Finance

AI-driven customer service in finance offers several advantages compared to traditional customer service methods. AI-powered chatbots, for example, can provide instant responses to customer queries, 24/7, without the need for human intervention. This ensures quick resolution of issues and enhances the overall customer experience.

Additionally, AI can analyze customer data in real-time to offer personalized recommendations and solutions, leading to a more tailored and efficient service delivery.

Personalized Financial Services with AI

AI enables financial institutions to offer personalized financial services to customers based on their individual needs and preferences. By analyzing vast amounts of data, AI algorithms can identify patterns and trends in customer behavior, allowing institutions to tailor their services accordingly.

For example, AI can provide personalized investment recommendations, budgeting advice, or even customized product offerings, leading to a more engaging and satisfying customer experience.

AI for Fraud Detection and Security

AI plays a crucial role in detecting and preventing financial fraud by leveraging advanced algorithms and machine learning capabilities.

Enhanced Security Measures with AI Algorithms

AI algorithms enhance security measures in digital finance by continuously analyzing vast amounts of data to detect patterns and anomalies that may indicate fraudulent activities. These algorithms can quickly identify suspicious transactions, unusual behavior, or potential security breaches, allowing financial institutions to take immediate action to prevent fraud.

- AI-powered fraud detection systems can monitor real-time transactions and flag any unusual activities, such as large transactions or transactions from unfamiliar locations, for further investigation.

- Machine learning algorithms can learn from past fraudulent patterns and adapt to new fraud tactics, making them more effective in detecting emerging threats.

- AI can also analyze customer behavior and identify deviations from their usual patterns, helping to detect account takeovers or identity theft.

Examples of AI Systems Combating Financial Cybercrime

AI systems have been effectively combating financial cybercrime by providing real-time fraud detection and enhancing security measures in digital finance.

One example is the use of AI-powered algorithms by banks to analyze customer data and transaction history, flagging any suspicious activities that may indicate fraudulent behavior.

- Another example is the implementation of AI chatbots that can verify customer identities through natural language processing, reducing the risk of identity theft and account fraud.

- Fraud detection systems powered by AI can also detect sophisticated fraud schemes, such as phishing attacks or ransomware, by analyzing patterns and anomalies in network traffic or user behavior.

The Future of AI in Digital Finance

As we look ahead to the future of AI in digital finance, it is clear that emerging trends in artificial intelligence will continue to revolutionize the financial industry. The potential impact of AI advancements on financial services is immense, paving the way for innovative solutions that will shape the way we interact with money and investments.

AI-Powered Personalized Financial Advice

One of the key trends that will define the future of digital finance is the use of AI to provide personalized financial advice to individuals. By leveraging machine learning algorithms, financial institutions can analyze vast amounts of data to offer tailored recommendations on savings, investments, and financial planning strategies.

Blockchain and AI Integration

Another exciting development on the horizon is the integration of blockchain technology with AI in financial services. This combination has the potential to enhance security, transparency, and efficiency in transactions, paving the way for new decentralized financial systems and digital currencies.

AI-Driven Risk Management

AI is also set to play a crucial role in the future of risk management in the financial industry. By analyzing real-time data and market trends, artificial intelligence can help identify potential risks and opportunities, enabling financial institutions to make more informed decisions and mitigate potential losses.

Related topics

In this section, we will delve into various related topics in the realm of digital finance, exploring key concepts and their significance in the financial sector.

Finance Insights Daily

Finance Insights Daily plays a crucial role in providing industry professionals with valuable insights and updates on the latest trends, news, and developments in the financial sector. This platform offers real-time information that can help financial experts make informed decisions and stay ahead of the curve.

Smart Finance Word

Smart Finance Word is a concept that emphasizes the use of intelligent technologies and data analytics in financial management. In today’s digital age, this approach is essential for optimizing financial processes, reducing risks, and enhancing overall performance in the financial sector.

Digital Finance

The evolution of Digital Finance has revolutionized traditional financial services by leveraging technology to offer convenient, efficient, and secure financial solutions. This digital transformation has enabled individuals and businesses to access a wide range of financial services online, enhancing financial inclusion and accessibility.

Financial Advisor

A Financial Advisor plays a crucial role in guiding clients towards financial success by providing personalized financial advice, investment strategies, and risk management solutions. With their expertise and knowledge, Financial Advisors help individuals and businesses make sound financial decisions and achieve their long-term financial goals.

Future Skills Program

The Future Skills Program is designed to prepare professionals for AI-driven financial roles by equipping them with the necessary skills, knowledge, and expertise to navigate the evolving landscape of digital finance. This program focuses on developing critical skills such as data analysis, machine learning, and financial modeling to empower professionals for the future of finance.

Conclusive Thoughts

In conclusion, the integration of AI in digital finance represents a transformative shift in the industry, promising enhanced efficiency, security, and personalized experiences for all stakeholders. As we look towards the future, the role of AI in financial solutions only continues to evolve, shaping a landscape that is ripe with possibilities.

FAQ Summary

How is AI revolutionizing digital finance solutions?

AI is transforming digital finance by automating processes, analyzing data at scale, and providing insights for better decision-making, ultimately enhancing efficiency and accuracy in financial operations.

What are some examples of successful AI implementations in digital finance?

Examples include AI-powered chatbots for customer service, algorithms for fraud detection, and predictive analytics for investment recommendations, all contributing to a more streamlined and effective financial ecosystem.

How does AI enhance customer experience in digital finance?

AI technologies enable personalized recommendations, faster query responses, and improved security measures, offering customers a seamless and tailored financial experience that meets their individual needs and preferences.