Embark on a journey into the world of financial advisor strategies for debt reduction and management. Discover how these professionals help clients effectively navigate their way out of debt and towards financial freedom.

Learn about successful debt reduction plans, personalized strategies, and the pivotal role of financial advisors in shaping a secure financial future.

Financial Advisor Strategies for Debt Reduction and Management

Financial advisors play a crucial role in helping individuals effectively reduce and manage their debt burden. By providing personalized strategies and guidance, financial advisors empower clients to take control of their finances and work towards a debt-free future.

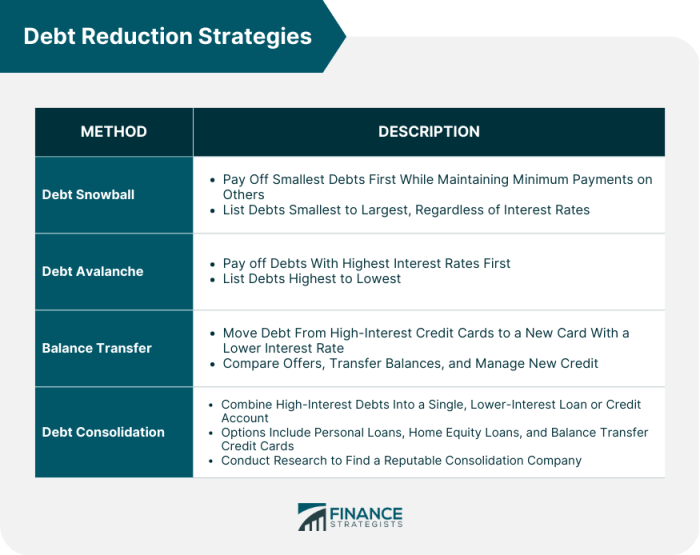

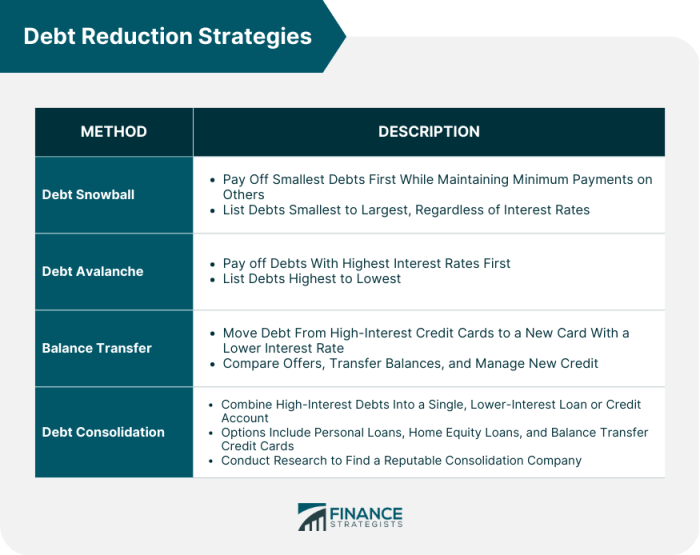

Common Strategies Used by Financial Advisors

- Creating a budget: Financial advisors assist clients in developing a comprehensive budget that accounts for all income sources and expenses. This helps prioritize debt payments and identify areas where spending can be reduced.

- Debt consolidation: Consolidating high-interest debts into a single, lower-interest loan can help simplify payments and reduce overall interest costs.

- Negotiating with creditors: Financial advisors can negotiate with creditors on behalf of clients to lower interest rates, waive fees, or create more manageable repayment plans.

Successful Debt Reduction Plans Implemented by Financial Advisors

- Case Study 1: By creating a strict budget and focusing on paying off high-interest debts first, a financial advisor helped a client eliminate $20,000 in credit card debt within two years.

- Case Study 2: Through debt consolidation and disciplined budgeting, a client successfully paid off a $50,000 student loan in five years, saving thousands in interest charges.

Importance of Personalized Debt Management Strategies

Every individual’s financial situation is unique, requiring a tailored approach to debt management. Financial advisors assess clients’ income, expenses, debt levels, and financial goals to create a personalized plan that aligns with their specific needs and priorities.

Role of Financial Advisors in Educating Clients

- Financial literacy: Financial advisors educate clients on the fundamentals of debt reduction, budgeting, saving, and investing to build a strong foundation for long-term financial success.

- Empowerment: By providing knowledge and resources, financial advisors empower clients to make informed financial decisions and take control of their debt management journey.

Finance Insights Daily

Finance Insights Daily is a platform designed to provide users with valuable financial information and insights on a daily basis. The platform caters to individuals who are looking to stay informed about the latest trends, updates, and developments in the world of finance.Users can expect to find a wide range of financial information on Finance Insights Daily, including market analysis, investment tips, personal finance advice, and updates on economic indicators.

The platform aims to help users make informed financial decisions by providing them with timely and relevant insights.Staying updated with daily finance insights is crucial for individuals looking to manage their finances effectively. By staying informed about market trends, economic developments, and investment opportunities, users can make better financial decisions and optimize their financial strategies.Some valuable insights that users may discover on Finance Insights Daily include tips for debt reduction and management, investment opportunities in emerging markets, updates on key economic indicators, and strategies for building a strong financial portfolio.

By leveraging these insights, users can enhance their financial literacy and make informed decisions to secure their financial future.

Smart Finance Word

Smart Finance Word encompasses a set of financial strategies and principles aimed at promoting financial literacy, awareness, and long-term stability. By following these principles, individuals can effectively manage their finances, reduce debt, and secure their financial future.

Role in Promoting Financial Literacy and Awareness

Smart Finance Word plays a crucial role in promoting financial literacy and awareness by educating individuals on various aspects of personal finance. It helps people understand the importance of budgeting, saving, investing, and debt management. By spreading awareness about these key financial concepts, Smart Finance Word empowers individuals to make informed decisions about their money.

- Smart Finance Word emphasizes the importance of creating a budget and sticking to it to track expenses and prioritize financial goals.

- It educates individuals on the significance of saving for emergencies and long-term financial objectives, such as retirement.

- Smart Finance Word also highlights the benefits of investing wisely to grow wealth over time and achieve financial independence.

By promoting financial literacy and awareness, Smart Finance Word helps individuals make sound financial decisions and build a secure financial future.

Benefits of Implementing Smart Finance Word Principles

Implementing Smart Finance Word principles can benefit individuals in various ways, including:

- Reducing debt and avoiding financial pitfalls by making informed decisions about borrowing and managing credit responsibly.

- Building a strong financial foundation through effective budgeting, saving, and investing strategies.

- Improving financial well-being and achieving long-term financial stability by following sound financial practices.

Tips for Long-Term Financial Stability

To incorporate Smart Finance Word strategies for long-term financial stability, individuals can consider the following tips:

- Create a detailed budget that accounts for all income and expenses, including savings goals and debt repayment.

- Automate savings and bill payments to ensure consistency and avoid missed payments or late fees.

- Diversify investments to minimize risk and maximize returns over time.

- Regularly review and adjust financial goals and strategies based on changing circumstances and priorities.

Digital Finance

Digital finance is revolutionizing the way we manage our finances, offering a wide range of benefits and challenges. As traditional financial services evolve to adapt to the digital age, it is important to understand the impact of digital finance on consumers and businesses alike.

Advantages of Digital Finance

- Convenience: Digital finance allows users to access their financial information anytime, anywhere, making it easier to track expenses and manage budgets.

- Cost Savings: By reducing the need for physical infrastructure and paperwork, digital finance can lead to cost savings for both financial institutions and consumers.

- Increased Access: Digital finance has the potential to reach underserved populations who may not have access to traditional banking services, promoting financial inclusion.

- Enhanced Security: With advanced encryption technologies and authentication methods, digital finance offers a secure way to conduct financial transactions.

Challenges of Transitioning to Digital Financial Tools

- Cybersecurity Risks: The increasing reliance on digital platforms exposes users to potential cyber threats such as data breaches and identity theft.

- Digital Literacy: Not all individuals are comfortable or familiar with using digital tools, creating a barrier to adoption for some segments of the population.

- Regulatory Compliance: Financial institutions must navigate complex regulations when implementing digital solutions, ensuring compliance with data protection and privacy laws.

Innovative Digital Finance Solutions

- Mobile Payment Apps: Platforms like Venmo and PayPal enable users to transfer money easily and securely using their smartphones.

- Robo-Advisors: Automated investment platforms offer personalized financial advice based on algorithms, making investing more accessible to the general public.

- Blockchain Technology: Cryptocurrencies and decentralized finance (DeFi) are leveraging blockchain technology to create new financial ecosystems outside of traditional banking systems.

Future Trends of Digital Finance

- Artificial Intelligence: AI-powered chatbots and virtual assistants are expected to enhance customer service and streamline financial processes.

- Open Banking: The rise of open banking APIs allows for seamless integration of financial data across multiple platforms, enabling a more holistic view of one’s finances.

- Biometric Authentication: The use of fingerprint scans and facial recognition for secure authentication is likely to become more prevalent in digital finance applications.

Future Skills Program

In today’s rapidly evolving finance industry, acquiring future skills is essential for career growth and professional development. A Future Skills Program is designed to equip individuals with the necessary knowledge and expertise to thrive in the finance sector of tomorrow.

Objectives and Structure of a Future Skills Program

A Future Skills Program focuses on enhancing technical skills, critical thinking, problem-solving abilities, and adaptability to new technologies in the finance industry. The program typically includes a combination of online courses, workshops, mentorship opportunities, and networking events to provide a comprehensive learning experience.

Importance of Acquiring Future Skills in Finance

Future-proofing your career

By staying updated with the latest trends and technologies, you can remain competitive in the finance industry.

Enhancing job prospects

Employers value candidates with a diverse skill set and a willingness to learn and adapt.

Career advancement

Acquiring future skills can open up opportunities for promotions and higher-paying roles in finance.

Success Stories of Individuals Benefiting from a Future Skills Program

- Jane, a financial analyst, participated in a Future Skills Program focused on data analytics and machine learning. She was able to leverage her new skills to streamline financial reporting processes and provide valuable insights to her team.

- Tom, a recent graduate, enrolled in a program that offered certification in blockchain technology. This unique skill set helped him secure a job at a fintech startup and kickstart his career in the finance industry.

Tips for Leveraging a Future Skills Program for Professional Development

Set clear goals

Identify areas of growth and skill development that align with your career aspirations.

Stay committed

Dedicate time and effort to actively participate in the program and complete assignments.

Network and collaborate

Engage with peers, mentors, and industry experts to expand your knowledge and opportunities in finance.

Apply new skills

Implement what you learn in real-world projects or scenarios to reinforce your understanding and demonstrate your capabilities to potential employers.

Last Recap

As we conclude our exploration of financial advisor strategies for debt reduction and management, remember that a solid plan and expert guidance can lead you towards a debt-free life and financial stability. Take the first step today.

Popular Questions

How do financial advisors help in reducing debt?

Financial advisors assist in analyzing your financial situation, creating a personalized plan, and providing guidance on managing debt effectively.

Why is personalized debt management important?

Personalized strategies take into account individual financial circumstances, making the approach more effective and sustainable in the long run.

What is the significance of financial planning in debt reduction?

Financial planning helps individuals set goals, prioritize debt repayment, and build a strong foundation for their financial future.