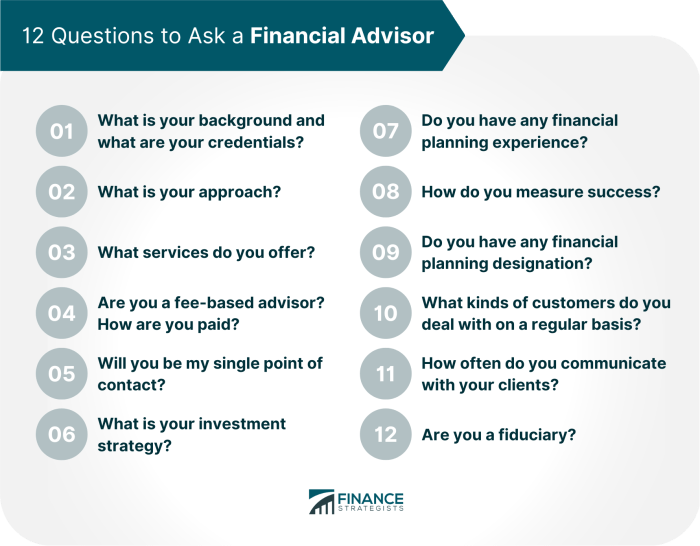

Exploring the essential questions to pose to your financial advisor in your initial meeting sets the stage for a successful financial planning journey. This guide will delve into the crucial inquiries that can shape your financial future, ensuring a fruitful partnership with your advisor.

As you embark on this pivotal first step towards securing your financial well-being, arming yourself with the right queries can pave the way for informed decisions and tailored strategies.

Importance of First Meeting

The first meeting with your financial advisor is a crucial step in setting the foundation for your financial planning journey. It is an opportunity to establish a relationship, discuss your goals, and Artikel a roadmap towards financial success.

Setting Expectations

During the first meeting, you have the chance to set expectations with your financial advisor. Clearly communicating your financial goals, risk tolerance, and expectations will help your advisor tailor their advice to meet your specific needs.

Building Trust

Building trust is essential in any client-advisor relationship. The first meeting is the perfect time to gauge whether you feel comfortable with your advisor and trust their expertise. Asking the right questions can help you assess their knowledge and determine if they are the right fit for you.

Establishing Communication

Effective communication is key to a successful financial planning journey. The first meeting sets the tone for how you and your advisor will communicate moving forward. By asking the right questions during this initial interaction, you can ensure that you are both on the same page and working towards your financial goals together.

Understanding Financial Goals

Defining your financial goals is a crucial step in your relationship with your financial advisor. It sets the foundation for creating a tailored financial plan that aligns with your specific needs and aspirations.

Importance of Clearly Defining Financial Goals

Clearly defining your financial goals allows your advisor to understand what you want to achieve and tailor their recommendations accordingly. Whether you are saving for retirement, planning to buy a home, or funding your child’s education, having clear goals helps prioritize and focus your financial strategy.

Aligning Goals with Advisor’s Expertise

By aligning your financial goals with your advisor’s expertise, you can benefit from their knowledge and experience in helping clients like you achieve similar objectives. For instance, if you have a goal of retiring early, working with an advisor who specializes in retirement planning can provide valuable insights and strategies to reach that goal efficiently.

Examples of Common Financial Goals

- Building an emergency fund to cover unexpected expenses

- Investing for wealth accumulation and financial growth

- Planning for major life events such as buying a home or starting a business

- Creating a retirement savings plan for financial security in later years

Advisor’s Qualifications and Experience

When choosing a financial advisor, it is crucial to consider their qualifications and experience. These factors play a significant role in determining the advisor’s ability to provide sound financial advice tailored to your specific needs.Experienced financial advisors often possess a combination of relevant qualifications and certifications that demonstrate their expertise in the field.

Look for advisors who hold certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Financial Consultant (ChFC). These designations indicate that the advisor has undergone rigorous training and has met certain professional standards.

Key Qualifications and Certifications

- Certified Financial Planner (CFP): Demonstrates expertise in financial planning, including investments, retirement planning, and tax strategies.

- Chartered Financial Analyst (CFA): Indicates a deep understanding of investment analysis and portfolio management.

- Chartered Financial Consultant (ChFC): Focuses on comprehensive financial planning, insurance, and estate planning.

Relevance of Experience

It is essential to consider the advisor’s experience in handling similar financial situations to yours. An advisor who has successfully navigated challenges and provided solutions in scenarios like yours is better equipped to offer practical advice.

Instilling Confidence

The advisor’s background and experience can instill confidence in their recommendations. Knowing that your advisor has successfully guided others through similar financial journeys can give you peace of mind and assurance that you are in capable hands.

Investment Approach and Strategy

When it comes to investment approach and strategy, your financial advisor may suggest a variety of options to help you achieve your financial goals. It is important to understand these strategies to make informed decisions about your investments.

Typical Investment Approaches and Strategies

- Passive Investing: This approach involves investing in a diversified portfolio of index funds or ETFs to achieve market returns.

- Active Investing: This strategy involves actively buying and selling investments in an attempt to outperform the market.

- Value Investing: This approach focuses on finding undervalued securities with the potential for long-term growth.

Risk Tolerance Assessment Process

- Assessing your risk tolerance is crucial in determining the right investment strategy for you. Your advisor will typically ask you questions about your comfort level with market fluctuations and potential losses.

- Understanding your risk tolerance helps your advisor create a portfolio that aligns with your financial goals and risk preferences.

- It is important to be honest and open about your risk tolerance to ensure that the investment strategy proposed is suitable for your individual needs.

Examples of Diversified Investment Portfolios and Their Benefits

- A diversified portfolio may include a mix of stocks, bonds, real estate, and other asset classes to reduce risk and maximize returns.

- Benefits of diversification include lower volatility, risk mitigation, and the potential for higher returns over the long term.

- Your advisor may show you examples of diversified portfolios tailored to different risk profiles to help you understand the benefits of a well-balanced investment strategy.

Fee Structure and Services

When meeting with a financial advisor for the first time, it’s crucial to understand the fee structure they operate on and the services they offer. This information will help you determine if their offerings align with your financial goals and needs.Explaining the different fee structures that financial advisors commonly use can shed light on how they are compensated for their services.

It’s essential to ask about any potential conflicts of interest that may arise from their fee structure.

Fee Structures

- Commission-Based: Advisors earn commissions by selling financial products like mutual funds, insurance policies, and annuities. This may lead to bias towards products that offer higher commissions.

- Fee-Only: Advisors charge a flat fee, hourly rate, or a percentage of assets under management. This fee structure is often seen as more transparent and may reduce conflicts of interest.

- Fee-Based: Advisors may charge a combination of fees and commissions. It’s essential to clarify how much of their compensation comes from fees versus commissions.

Services Offered

- Financial Planning: Creating a comprehensive financial plan tailored to your goals and circumstances.

- Investment Management: Managing your investment portfolio to help you achieve your financial objectives.

- Risk Management: Evaluating and mitigating risks related to your financial situation, such as insurance coverage.

- Estate Planning: Assisting with the distribution of assets and minimizing estate taxes.

Advantages and Disadvantages of Fee Structures

- Advantages of Fee-Only Advisors:

- Reduced conflicts of interest.

- Transparent fee structure.

- Objective advice without product bias.

- Advantages of Commission-Based Advisors:

- No upfront fees for services.

- Potential for lower costs for certain products.

- May be suitable for one-time transactions.

- Disadvantages of Fee-Only Advisors:

- Higher upfront costs for services.

- May not be cost-effective for smaller portfolios.

- Disadvantages of Commission-Based Advisors:

- Potential for product bias due to commissions.

- Less transparent fee structure.

- May prioritize products with higher commissions.

Communication and Updates

Effective communication between you and your financial advisor is crucial for a successful partnership. It ensures that you are always informed about your financial progress and can make well-informed decisions.

Frequency of Updates

- Your advisor should discuss with you the frequency of updates on your financial progress and portfolio performance. This could be monthly, quarterly, or semi-annually, depending on your preferences and the complexity of your financial situation.

Communication Methods

- Your advisor may use a variety of communication methods to keep you informed, such as in-person meetings, phone calls, emails, or reports. These methods allow for effective and timely updates on your investments and financial goals.

- Regular meetings can provide you with the opportunity to discuss any changes in your financial situation, ask questions, and receive personalized advice.

- Email updates or reports can also help you stay informed about your portfolio performance and any recommendations from your advisor.

Compliance and Regulation

When it comes to financial advisors, compliance and regulation play a crucial role in ensuring accountability and transparency in the industry.

Regulatory Requirements for Financial Advisors

- Financial advisors are required to be registered with regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

- Advisors must adhere to strict guidelines and codes of conduct set by these regulatory authorities to protect clients’ interests.

- They are required to disclose any conflicts of interest and provide full transparency in their dealings with clients.

Importance of Compliance for Client Protection

- Compliance ensures that financial advisors act in the best interests of their clients, putting client protection at the forefront of their services.

- By following regulatory requirements, advisors provide transparency in their recommendations and ensure that clients are well-informed about the risks involved in their investments.

- Working with a registered advisor gives clients a sense of security and accountability, knowing that their financial interests are being safeguarded.

Finance Insights Daily

Finance Insights Daily is a comprehensive platform that provides users with valuable financial information and news to help them make informed decisions about their finances.

Overview

- Users can expect to find a wide range of financial information, including market updates, investment insights, economic trends, and personal finance tips.

- The platform aggregates content from reputable sources to ensure users have access to reliable and up-to-date information.

Benefits

- Finance Insights Daily helps individuals stay informed about the latest financial trends and developments, allowing them to make informed decisions about their investments and financial goals.

- By providing a one-stop platform for financial news and information, users can save time and effort in staying up-to-date with the financial landscape.

Smart Finance Word

When it comes to navigating the complex world of finance, understanding key terminologies and concepts is crucial. This is where ‘Smart Finance Word’ plays a vital role in promoting financial literacy and education among individuals.

Importance of Financial Literacy

Financial literacy is the cornerstone of making informed decisions about money management, investments, and financial planning. By breaking down complex financial terms into simple, easy-to-understand explanations, ‘Smart Finance Word’ helps individuals enhance their financial knowledge and confidence.

- Compound Interest: The concept of earning interest on both the initial principal and the accumulated interest on investments or savings over time.

- Asset Allocation: The strategy of spreading investments across different asset classes to manage risk and optimize returns.

- Diversification: The practice of investing in a variety of assets to reduce risk exposure to any single investment.

Digital Finance

With the advancement of technology, digital finance has transformed the traditional financial services industry in various ways.

Impact of Digital Finance

Digital finance has revolutionized the way financial services are accessed and managed, offering numerous benefits to both consumers and financial institutions.

- Increased Accessibility: Digital finance has made financial services more accessible to a wider range of individuals, including those in remote areas or with limited physical mobility.

- Enhanced Convenience: Through digital platforms, individuals can now conduct various financial transactions from the comfort of their homes or on-the-go using their smartphones or computers.

Benefits of Digital Finance

There are several benefits associated with digital finance that have significantly impacted the financial industry.

- Efficiency: Digital finance tools streamline processes and reduce the time required for transactions, making financial management more efficient.

- Cost-Effective: Digital platforms often offer lower fees and costs compared to traditional financial services, providing cost savings for users.

- Personalization: Digital finance tools can analyze user data to offer personalized financial recommendations and services tailored to individual needs.

Examples of Digital Finance Tools

Various digital finance tools and platforms have emerged, revolutionizing how financial services are delivered and accessed.

- Mobile Payment Apps: Platforms like Venmo, PayPal, and Square Cash have transformed the way people send and receive money, making transactions quick and convenient.

- Robo-Advisors: Automated investment platforms like Betterment and Wealthfront use algorithms to provide investment advice and manage portfolios, offering a cost-effective alternative to traditional financial advisors.

- Cryptocurrency Exchanges: Platforms such as Coinbase and Binance allow users to buy, sell, and trade cryptocurrencies, introducing a new form of digital currency and investment opportunities.

Financial Advisor

Financial advisors are professionals who provide guidance and advice on various financial matters to individuals and businesses. They play a crucial role in helping clients manage their finances, plan for the future, and make informed investment decisions.They are responsible for assessing a client’s financial situation, understanding their goals and risk tolerance, and developing personalized strategies to help them achieve their objectives.

Financial advisors also monitor the performance of investments, provide ongoing support, and adjust plans as needed to ensure financial success.

Role and Responsibilities

Financial advisors help clients navigate complex financial landscapes by offering expertise and knowledge in areas such as retirement planning, investment management, tax planning, estate planning, and insurance. They work closely with clients to create comprehensive financial plans tailored to their unique needs and circumstances.

- Educating clients on various investment options and strategies.

- Monitoring and adjusting investment portfolios to align with client goals.

- Providing guidance on retirement planning and income distribution.

- Assisting with tax planning strategies to minimize liabilities.

- Offering advice on estate planning and wealth transfer.

Value of a Financial Advisor

Financial advisors bring a wealth of knowledge and expertise to the table, helping individuals make informed decisions that can lead to financial security and success. They provide personalized guidance and support, helping clients navigate complex financial decisions with confidence.

- Helping clients set realistic financial goals and develop a plan to achieve them.

- Offering objective advice based on a client’s best interests.

- Providing ongoing support and monitoring to keep clients on track.

- Bringing specialized knowledge and expertise to complex financial matters.

- Assisting clients in adapting to changing financial circumstances.

Benefits of Consulting a Financial Advisor

Consulting a financial advisor can be highly beneficial in various situations, such as planning for retirement, managing an inheritance, starting a business, or navigating a financial crisis. Advisors can provide valuable insights, strategies, and support to help clients make sound financial decisions and secure their financial future.

- Creating a comprehensive financial plan tailored to individual goals.

- Maximizing investment returns while minimizing risks.

- Ensuring proper asset allocation to meet long-term objectives.

- Advising on tax-efficient strategies to optimize financial outcomes.

- Providing peace of mind and confidence in financial decisions.

Future Skills Program

The Future Skills Program is designed to help individuals acquire the necessary skills and knowledge to thrive in the rapidly evolving job market. By participating in this program, individuals can enhance their employability and adaptability to new technologies and industry trends.

Purpose and Objectives

The main objective of the Future Skills Program is to equip individuals with the skills needed to succeed in a digital and data-driven economy. Participants will learn about emerging technologies, digital literacy, data analysis, and other relevant competencies to stay competitive in the job market.

Skills and Knowledge

- Developing proficiency in coding languages and software tools.

- Understanding data analytics and interpretation.

- Enhancing critical thinking and problem-solving abilities.

- Improving communication and collaboration skills.

- Acquiring knowledge of cybersecurity and digital privacy.

Success Stories

“After completing the Future Skills Program, I was able to secure a job in a leading tech company and apply my newly acquired skills in real-world projects. The program not only boosted my confidence but also opened up new career opportunities for me.”

John Doe

“The Future Skills Program helped me transition from a traditional role to a digital marketing specialist. The hands-on training and expert guidance provided me with the tools I needed to excel in a tech-savvy environment.”

Jane Smith

Wrap-Up

In conclusion, the key questions discussed in this guide serve as a foundation for a productive relationship with your financial advisor, enabling you to navigate the complexities of financial planning with confidence and clarity. By asking the right questions from the outset, you empower yourself to make informed choices that align with your goals and aspirations.

Expert Answers

What qualifications should I look for in a financial advisor?

Look for certifications like CFP (Certified Financial Planner) or ChFC (Chartered Financial Consultant) to ensure your advisor has the necessary expertise.

How can I align my financial goals with my advisor’s expertise?

Discuss your goals in detail and assess if your advisor has experience in handling similar objectives to ensure alignment.

What are the advantages of fee-only advisors over commission-based ones?

Fee-only advisors are compensated directly by clients, avoiding conflicts of interest that might arise with commission-based advisors.

How often should I expect updates on my financial progress?

Your advisor should provide regular updates based on your preferences, whether through meetings, emails, or reports, to keep you informed.