Delving into the realm of impact investing opens up a world of possibilities where financial decisions can drive positive change. From understanding the core principles to exploring innovative platforms and success stories, this guide unravels the intricacies of impact investing in the modern finance landscape.

As we navigate through the nuances of impact investing, the journey unfolds with insights that pave the way for informed decision-making and a deeper understanding of the interconnectedness between finance and societal impact.

Impact Investing Introduction

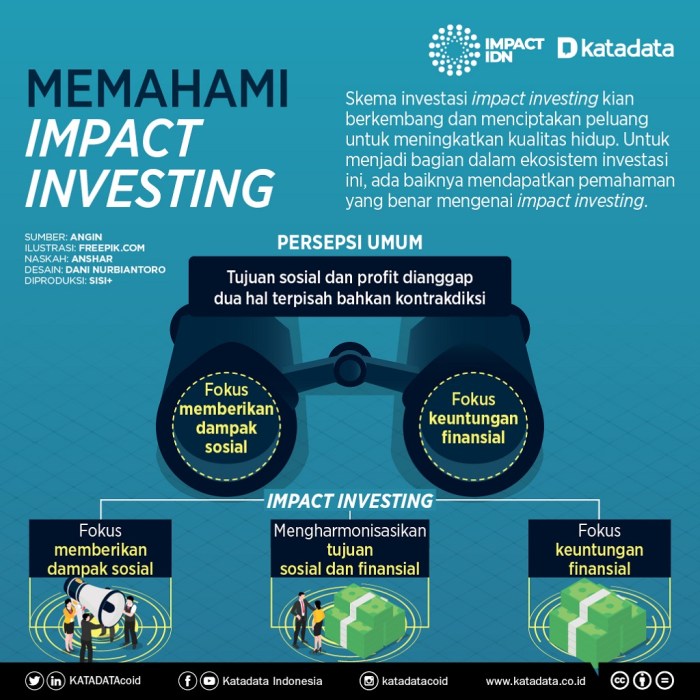

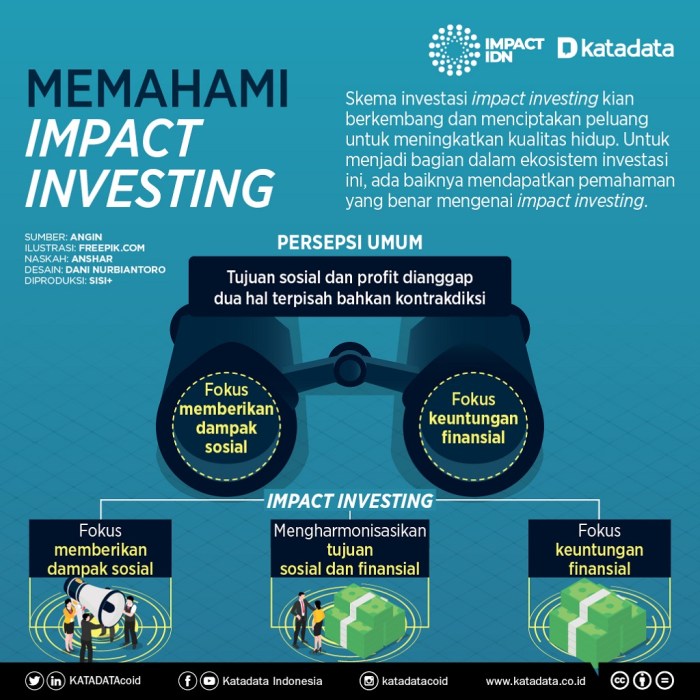

Impact investing is a strategy that aims to generate positive social or environmental impact alongside financial returns. It has gained significant traction in the finance world as investors seek to align their values with their investment decisions. By directing capital towards projects that address pressing issues such as climate change, poverty alleviation, and healthcare access, impact investing plays a crucial role in creating a more sustainable and equitable future.

Examples of Successful Impact Investing Projects

Impact investing has led to the success of various projects around the world, including:

- An affordable housing initiative that provides low-income families with stable and safe housing options.

- A renewable energy project that reduces carbon emissions and promotes clean energy sources.

- A social enterprise focused on empowering women entrepreneurs in developing countries through access to capital and resources.

Key Principles and Objectives of Impact Investing

Impact investing is guided by several key principles and objectives, including:

- Intentionality: Investors actively seek to generate positive impact through their investments.

- Measurable Impact: Projects are evaluated based on their social and environmental outcomes in addition to financial returns.

- Transparency: Clear reporting mechanisms ensure accountability and credibility in impact investing efforts.

- Financial Sustainability: Investments are structured to be financially viable while creating positive change.

Difference between Traditional Investing and Impact Investing

While traditional investing focuses primarily on financial returns, impact investing goes beyond profits to consider the broader impact of investments on society and the environment. Unlike traditional investing, impact investing aims to address specific social or environmental challenges while still generating financial returns for investors.

Smart Finance World Resources

When it comes to learning about impact investing, there are several reputable online platforms that provide valuable resources to enhance your knowledge in this area.

Reputable Online Platforms for Learning

Some of the top online platforms for learning about impact investing include:

- GIIN (Global Impact Investing Network): Provides insights, research, and tools for impact investors.

- ImpactAlpha: Offers news, analysis, and data on impact investing trends and opportunities.

- Stanford Social Innovation Review: Features articles and case studies on social impact and investing.

Top Books/Publications on Impact Investing

Here are some recommended books/publications on impact investing:

- “The Impact Investor” by Jed Emerson and Antony Bugg-Levine

- “Investing for Impact” by Tideline

- “The Power of Impact Investing” by Judith Rodin and Margot Brandenburg

Impact Investing Shaping the Future of Finance

Impact investing is increasingly shaping the future of finance by integrating social and environmental considerations into investment decisions. This approach not only aims for financial returns but also seeks to generate positive impact on society and the planet.

Impact investing is moving beyond traditional philanthropy towards sustainable and scalable solutions for global challenges.

Role of Technology in Impact Investing

Technology plays a crucial role in driving impact investing initiatives by enabling better data analysis, monitoring, and evaluation of social and environmental outcomes. Platforms utilizing artificial intelligence and blockchain technology are revolutionizing the way impact investments are made and managed.

Finance Insights Daily

Finance Insights Daily is a valuable resource that provides daily updates on finance trends, news, and market developments. It offers a convenient way to stay informed about the latest happenings in the financial world, including insights on impact investing.

Relevance of Finance Insights Daily

Finance Insights Daily plays a crucial role in helping individuals and businesses stay updated on the ever-changing landscape of finance. By accessing daily insights, one can gain a better understanding of market trends, investment opportunities, and potential risks. This information is especially useful for those interested in impact investing, as it allows them to track relevant news and developments in this area.

Tips for Leveraging Finance Insights Daily

- Set aside time each day to review the latest insights and news updates to stay informed.

- Use the information provided to identify potential impact investment opportunities and make well-informed decisions.

- Engage with the content by actively seeking out additional resources or conducting further research on topics of interest.

Benefits of Daily Finance Insights

Incorporating daily finance insights into investment strategies can lead to more informed decision-making and better portfolio management. By staying up-to-date on market trends and developments, investors can adjust their strategies accordingly and seize opportunities as they arise. This proactive approach can help enhance overall investment performance and mitigate risks.

Examples of Impactful Insights

Through Finance Insights Daily, investors can gain access to impactful insights such as:

- Emerging trends in sustainable finance and impact investing.

- Key regulatory changes affecting the finance industry and investment landscape.

- Case studies highlighting successful impact investment projects and their outcomes.

- Analysis of market performance and opportunities for socially responsible investing.

Smart Finance Word

Smart Finance Word is a platform dedicated to promoting financial literacy and empowering individuals to make informed decisions about their finances. By providing valuable resources and insights, Smart Finance Word aims to educate and guide individuals towards financial success.

Resources for Learning Impact Investing

- Articles and Guides: Smart Finance Word offers a range of articles and guides on impact investing, covering topics such as sustainable investing, ESG criteria, and measuring impact.

- Webinars and Workshops: Individuals can participate in webinars and workshops hosted by Smart Finance Word experts to gain a deeper understanding of impact investing strategies and best practices.

- Case Studies: Real-life examples and success stories of impact investors are shared on Smart Finance Word to inspire and educate others on the positive outcomes of impactful financial decisions.

Success Stories

- John, a young professional, used the resources on Smart Finance Word to learn about impact investing and successfully diversified his portfolio to include socially responsible investments.

- Emily, a small business owner, implemented sustainable practices in her business after gaining insights from Smart Finance Word, leading to increased profitability and positive social impact.

Importance of Continuous Learning

Continuous learning through platforms like Smart Finance Word is crucial in the ever-evolving world of finance. By staying informed and up-to-date on impact investing trends and strategies, individuals can make informed decisions that not only benefit their financial well-being but also contribute to positive social and environmental change.

Digital Finance

Digital finance plays a crucial role in the realm of impact investing, merging technology with financial strategies to drive positive social and environmental change. The use of digital tools and platforms has revolutionized the landscape of impact investing, providing new opportunities for investors to support impactful initiatives.

Intersection of Digital Finance and Impact Investing

The intersection of digital finance and impact investing has paved the way for innovative solutions that leverage technology to address social and environmental challenges. Digital platforms enable investors to easily identify and invest in projects that align with their values and impact goals.

By streamlining the investment process and providing real-time data and analytics, digital finance tools empower investors to make informed decisions that drive positive change.

- Online Impact Investment Platforms: Platforms like Swell Investing and Ethic make it easy for individuals to invest in socially responsible companies and impact-driven projects.

- Crowdfunding Platforms: Platforms such as Kiva and Kickstarter allow investors to support small businesses and social enterprises directly, contributing to economic empowerment and sustainable growth.

- Blockchain Technology: Blockchain has the potential to increase transparency and accountability in impact investing by securely tracking investments and ensuring funds are allocated to the intended projects.

Future Trends in Digital Finance and Impact Investing

As technology continues to evolve, the future of digital finance and impact investing holds promising trends that are set to reshape the industry. From the rise of artificial intelligence and machine learning to the mainstream adoption of blockchain technology, the future of impact investing is poised for transformation.

- Personalized Impact Investing: With the use of big data and AI, investors will have access to personalized impact investment opportunities tailored to their values and financial goals.

- Tokenization of Assets: Tokenization allows for fractional ownership of assets, making impact investing more accessible to a broader audience and increasing liquidity in impact markets.

- Regulatory Developments: Regulatory frameworks are evolving to support the growth of impact investing, providing clarity and guidelines for investors and organizations operating in this space.

Financial Advisor

Financial advisors play a crucial role in guiding clients towards impactful investing opportunities that align with their financial goals and values. They help clients navigate the complex landscape of impact investing and make informed decisions to create a positive social or environmental impact while aiming for financial returns.

Choosing a Financial Advisor for Impact Investing

When selecting a financial advisor who specializes in impact investing, consider the following tips:

- Look for advisors with relevant experience and expertise in impact investing.

- Check if the advisor is certified or accredited in sustainable and responsible investing.

- Inquire about the advisor’s track record with impact investments and the results achieved for clients.

- Ensure the advisor understands your values and objectives for impact investing.

Aligning Financial Goals with Impact Objectives

It is essential to align financial goals with impact objectives when working with a financial advisor to ensure a holistic approach to investing. By integrating impact objectives into financial planning, clients can pursue both financial returns and meaningful social or environmental impact.

This alignment helps in achieving long-term sustainability and fulfillment of personal values through investments.

Questions to Ask a Financial Advisor about Impact Investing Strategies

Before making investment decisions, consider asking your financial advisor the following questions:

- How do you incorporate impact investing into the overall investment strategy?

- Can you provide examples of successful impact investments you have recommended to clients?

- What criteria do you use to assess the impact potential of investment opportunities?

- How do you measure and report the social or environmental impact of impact investments?

Future Skills Program

As the finance industry continues to evolve, the concept of a Future Skills Program has become increasingly relevant. This program focuses on equipping individuals with the necessary skills and knowledge to navigate the changing landscape of finance effectively.

Relevance in the Finance Industry

A Future Skills Program in the finance industry helps professionals stay updated with the latest trends, technologies, and strategies. It enables individuals to adapt to new challenges and opportunities, ensuring their continued success in a competitive environment.

Skills and Knowledge in Impact Investing

A Future Skills Program focusing on impact investing provides participants with a deep understanding of sustainable finance, ESG (Environmental, Social, and Governance) criteria, and ethical investment practices. It also covers financial analysis techniques specific to impact investing, helping individuals make informed decisions that align with their values and financial goals.

Success Stories

- John, a financial analyst, enhanced his career prospects by completing a Future Skills Program in impact investing. He now leads a team dedicated to managing sustainable investment portfolios, driving positive change in the finance industry.

- Sarah, a young professional, transitioned from traditional finance to impact investing after completing a Future Skills Program. She now works for a socially responsible investment firm, helping clients achieve their financial objectives while making a positive impact on society.

Importance of Continuous Upskilling

In the rapidly evolving finance landscape, continuous upskilling and reskilling are crucial for professionals to stay competitive and relevant. A Future Skills Program provides individuals with the tools and knowledge needed to adapt to changing market dynamics, fostering innovation and growth in their careers.

Last Point

In conclusion, Smart finance world resources for learning about impact investing offer a gateway to a realm where financial acumen meets social consciousness. By embracing the principles of impact investing and leveraging the tools and platforms available, individuals can pave the path for a more sustainable and purpose-driven financial future.

Essential Questionnaire

How can impact investing contribute to positive social change?

Impact investing directs capital towards projects and companies that generate measurable social and environmental impact alongside financial returns.

What are some reputable online platforms for learning about impact investing?

Platforms like ImpactAlpha, GIIN, and Ethex provide valuable resources and insights for individuals interested in impact investing.

How does digital finance intersect with impact investing?

Digital tools and platforms are revolutionizing impact investing by increasing accessibility, transparency, and efficiency in connecting investors with impactful opportunities.